Tax ID Number Canada

What Is a Tax ID Number In Canada (and Why You Need It) Have you ever heard someone say, “Taxes are certain, but death isn’t?” …

Spousal Support Tax Deduction

Is Spousal Support Tax Deductible? Who Can Claim & How? Divorce or separation is tough enough without the added stress of figuring out taxes. If …

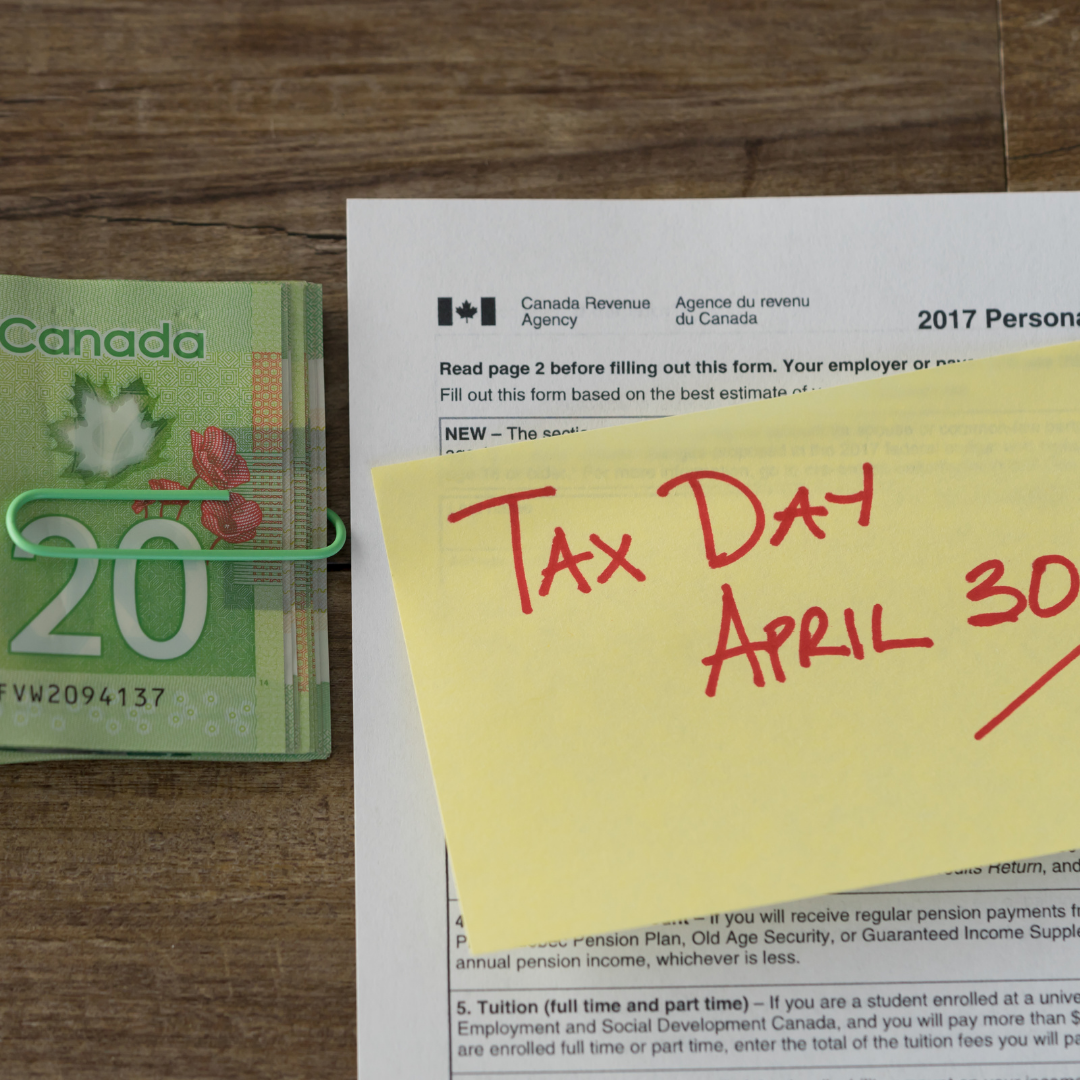

Late Tax Filing

What Happens If You File Your Taxes Late? Don’t Panic – Here’s What to Do Missed the tax deadline? Relax. Millions of Canadians file their …

Tax Deductible Legal Fees Canada

What Legal Fees Are Tax Deductible in Canada? Ever wondered if those pesky legal fees could actually lower your tax bill? Many Canadians miss out …

Union Dues Tax Deductible

Are Union Dues Tax Deductible? Everything You Need to Know Are you a union member wondering if those dues could be saving you some serious …

Is RESP Tax Deductible?

Is RESP Tax Deductible? A Complete Guide for Canadian Parents (2024) Saving for your child’s education is no small feat, and it’s natural to wonder …

Tax Refunds for International Students in Canada

Can International Students Get Tax Refund on Tuition in Canada? (Ultimate Guide) Ever feel like those tuition bills just keep piling up? Like there’s no …

Does Everyone Get the Carbon Tax Rebate

Who Qualifies? Does Everyone Get the Carbon Tax Rebate? Are you missing out on the carbon tax rebate? Many people think this rebate is out …

Death Tax Canada

Is There a Death Tax in Canada? Everything You Need to Know Death and taxes. Two things you can’t avoid, right? Well, sort of. While …

Sleep Apnea Disability Tax Credit

Does Sleep Apnea Qualify for the Disability Tax Credit Tired of tossing and turning all night? If you’ve been diagnosed with sleep apnea, you might …

ADHD Disability Tax Credit

Does ADHD Qualify for Disability Tax Credit? ADHD can leave you feeling scattered, overwhelmed, and like you’re constantly playing catch-up. But what if there was …

Underused Housing Tax

What Is Underused Housing Tax? A Simple Guide for Homeowners Ever feel like the tax system is stacked against you? Like there’s always some new …

Inheritance Tax

What is Inheritance Tax? A Simple Guide for Understanding Inheritance? It’s not something most of us like to think about. But the last thing you …

What Is the Best Time to File Taxes in Canada

What Is the Best Time to File Taxes in Canada Tax season – that stressful time of year that rolls around with surprising speed. You …

Are Legal Fees Tax Deductible Canada

Are Legal Fees Tax Deductible In Canada Legal fees can feel like the final kick when you’re already down. But what if those hefty bills …

Ontario Staycation Tax Credit

What Is Ontario Staycation Tax Credit Imagine unlocking a financial perk that turns your local travels into a treasure hunt, where every staycation is more …

Where to Mail Your Canadian Tax Return

Where to Mail your Canadian Tax Return? Avoid Delays with Our Comprehensive Guide Have you ever wondered why some tax returns hit a snag while …

Can a Bookkeeper Do Tax Returns

Can a Bookkeeper Do Tax Returns? Navigating Tax Season Tax season: a time that can send shivers down the spine of even the most organized …

Can You Claim Training Courses on Tax in Canada

Can You Claim Training Courses on Tax in Canada Ever wondered if those training courses you’ve been eyeing could actually give back more than just …

Is Critical Illness Insurance Tax Deductible in Canada?

Is Critical Illness Insurance Tax Deductible in Canada Facing the unexpected can often leave us feeling like we’re walking a tightrope without a safety net. …

What Is Line 73 on Canadian Tax Return

What Is Line 73 on Canadian Tax Return? A Must-Know for Smarter Filing Diving into your Canadian tax return can feel like navigating a maze …

What is Probate Tax in Canada

What is Probate Tax in Canada? Simplifying the Complex for Beneficiaries Diving into the world of probate tax in Canada can feel like navigating a …

Is Public Transit Tax Deductible in Canada?

Is Public Transit Tax Deductible in Canada? Let’s Find Out Ever wondered if swiping your transit card could save you money at tax time? In …

Are Funeral Expenses Tax Deductible in Canada

Tax Relief in Tough Times: Are Funeral Expenses Tax Deductible in Canada? Navigating the financial aftermath of a loved one’s passing can be overwhelming, especially …

How to Save Tax in Canada

How to Save Tax in Canada – Insider Strategies Unveiled Ever wondered if you’re leaving money on the table come tax time? You’re not alone. …

Second CPP Contributions

Are you a high-income earner in Canada? If so, are you required to make second CPP contributions? The Government of Canada recognizes that saving for …

Understanding the Canada Pension Plan (CPP)

A recent survey found that retirement and affording the day-to-day expenses of having a family are the top two financial concerns of working Canadians. Can …

Alternative Minimum Tax (AMT)

Have you heard about recent AMT changes? Starting in 2024, more Canadians will be subject to AMT, making now the right time to re-evaluate your …

Toronto’s Vacant Home Tax

Do you have a vacant apartment or home? Whether you are out of the country traveling for work or have a second home that isn’t …

Canada Removes 5% Apartment Building Consumption Tax

Affordable housing has been at the forefront of concern for Canadian officials since the pandemic, with housing prices up 12% in 2023 alone. Couple a …

Canada Tech Tax 2024

Despite mounting opposition, Canada still plans on imposing a new digital services tax beginning in 2024. In this article, we’ll cover the basics of the …

Digital Services Tax Canada

The digital economy is here to stay, with Canada taking a proactive approach to the taxation of digital service businesses. The proposed Digital Services Act …

CPA Quebec and CPA Ontario Leave the CPA Canada Organization

Are you aware of the recent relationship split between CPA Canada and Ontario and Quebec? On Tuesday, June 20th, the Quebec and Ontario provincial bodies …

Understanding the Proposed New Mandatory Disclosure Rules

There has been talk about new Mandatory Disclosure Rules since the budget meeting in 2021; however, 2023 might finally be the year these rules go …

Day Trading in a TFSA: Still Under the Tax-Free Shield?

Are you getting into the day trading realm? Day trading has become a popular side hustle for many Canadians, with the average yearly earnings ranking …

Canada Workers Benefit

Do you make under $33,000 per year? If so, you may be entitled to claim the Canada Workers Benefit tax credit. This refundable credit was …

Understanding the Tax-Free First Home Savings Account

Whether you are fresh out of college looking for a place to live or growing your family, you’ve probably noticed that it’s much more difficult …

New Anti-Flipping Rules for Residential Real Estate

The Government of Canada is tightening the rules surrounding the real estate market. New regulations, like a ban on foreign buyers and an additional vacant …

Canada Dental Benefit: Who Qualifies and How to Apply

Do you have children that visit the dentist? Did you know that the Government of Canada now offers tax-free payments to help cover dental costs …

When Should You Apply for Your Pension in Canada?

Canada Pension Plan payments are not automatic, meaning you need to apply to enjoy monthly payments, but when should you apply? Properly timing the application …

Salary vs Dividend: Maximizing Tax Savings

When it comes time to take money out of your business, what’s the most beneficial way? Some business owners choose to set up a set …

Buying vs Leasing A Vehicle For A Business In Canada

Placing a Business Car in Service: Buy or Lease? Placing a car in service in your business provides more than just transportation to and from …

How to Avoid TFSA Overcontributions

Saving for retirement is no easy task, especially with the uncertainty surrounding financial markets and employment. This is why it’s no surprise that over 15 …

Benefits of Hiring a Tax Accountant

Are you constantly stressed during tax time? How about struggling to meet tax deadlines and unsure if you are filing correct returns? If so, you …

Why Should You Hire a Professional for Your Tax Return?

The Government of Canada released recent statistics that show nearly 28,100,000 returns were filed from February to June of 2022. Out of all these returns, …

How to Pay Your Taxes in Canada

Filing your individual tax return by April 30 each year is only half the battle for many Canadians with figuring out how to pay any …

What are the Benefits of RRSP?

According to recent statistics, 40% of Canadians have uncertainty surrounding their retirement with another 14% expecting to never retire. Do you fall into one of …

5 Tips for Reducing Your Tax Bill

Tax season is upon us, and once again it’s time to drag out those boxes of expense records you’ve been saving all year. Having a …

How To Track Your Expenses For Self-Employment

One of the most important things for any small business is to be organized and in control. The first step to doing this is to …

How Do You Pay Back COVID-19 Benefit Payments?

COVID 19 continues to impact the world, changing the way people run their lives and disrupting the flow of business. As a result, people are …

How to Inform CRA of An Address Change

It is common to change addresses, especially if you transfer from one city to another. If you don’t notify Canada Revenue Agency (CRA) about the …

Taxes for Remote Workers In Canada

There has been an increase in the number of remote workers in Canada, which has led to new rules for the employers whose employees work …

COVID 19 and Personal Taxes in Canada

COVID has impacted world economies, and the Canada recovery benefit (CERB) is among the governmental initiatives designed to shield citizens from the financial impact of …

Tax Requirements for Digital Marketers in Canada

Startups and businesses in their early stages usually have a difficult time complying with taxes. A lack of familiarity with the regulations and rules meant …